Managing your cash flows becomes essential if you want a secure future. You need to check your assets and liabilities ratio to determine whether you can pay bills. We seldom do not make a weekly or monthly budget to manage our finances. A listicle of the best budgeting app is all that you need.

You can record your transactions, look for the overspending areas, and save some bucks for your future. Not only this, there are multiple benefits of the best budgeting apps that make them an essential inclusion. Without any further delay, let’s start our listicle of the best budgeting apps.

Excited? So, Let’s Get Started.

Benefits Of Budgeting Apps in 2021

Keep track of cash flows: It is essential to track your cash flows. For that purpose, budgeting apps are the best option. You can keep track of all the inflows and outflows during the month. You can then analyze the cash flows and minimize your expenses by eliminating spendthrift.

Plan Monthly budgets: Once you are familiar with your spending pattern, you can prepare a monthly budget. You can consider all the essential expenses and minimize the unwanted ones in your budget. Ultimately, it will help you save a lot of money at the end of the year.

Identify spending habits: Best budgeting apps can help you identify spending habits. It will help you discover the overspending avenues that you will take care of while spending next time. It will also help you accumulate a lot of money at the end of the financial year.

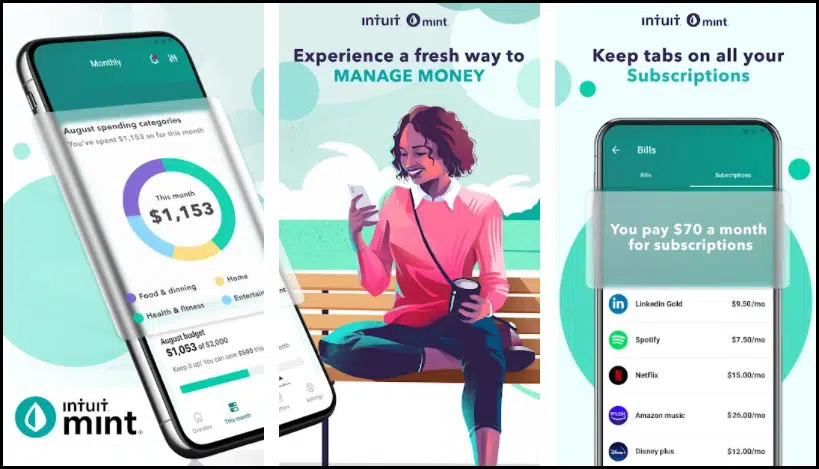

Mint – best budgeting app

Mint is a budgeting app that will manage your money in one place and keep track of your spending. The app brings together your bank account details, credit card details, and investments that help to know your financial position. The app gives you monthly bill reminders to pay your bills on time.

The app suggests actionable saving tips that will help you reach your goals. You also get recommendations to prepare a healthy budget based on your spending history. The app recommends a weekly and monthly budget that will help to save bucks.

You can also learn some tips about your credit scores that will be handy in calculating your creditworthiness. This all-in-one financial app could be one of the best budgeting apps if you are hunting for one.

Related: Best Translation Apps

Standout Features:

- Monthly bill payment reminders

- Handy recommendations

- Multi-utility

Download This Best Budgeting App

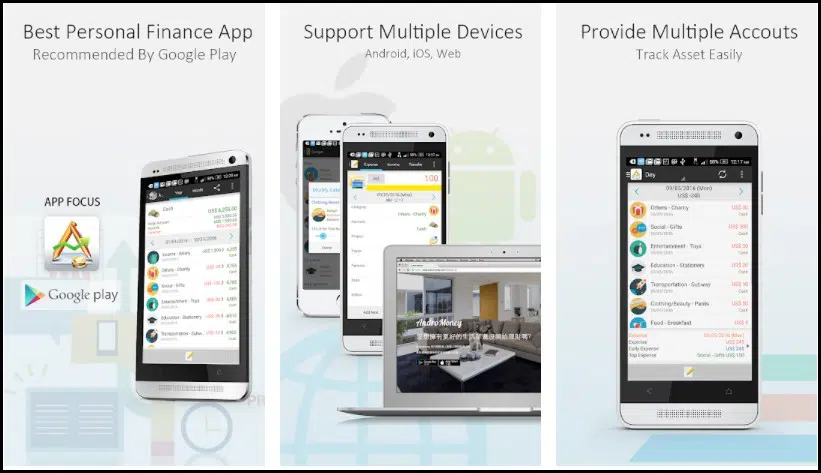

AndroMoney – best app for budgeting

Create custom budgets with the AndroMoney app. You get hierarchical categories with custom attributes that will help you in creating monthly budgets. You can feed any currency in the app with downloadable rates, making it one of the best budgeting apps. The app has a number pad that will help you approximate your budget.

With the help of the trend, pie, and bar charts, you can track your budget conveniently. You can have an overview of the monthly expenses so that you can identify the spending pattern. The income summary feature will help you know the liquid assets and asset inflow during the month. You can sync your data with other devices for easy access anywhere.

Related: Best Meal Planning Apps

Standout Features:

- Income summary

- Pie and bar charts

- Custom attributes

Download This Best Budgeting App

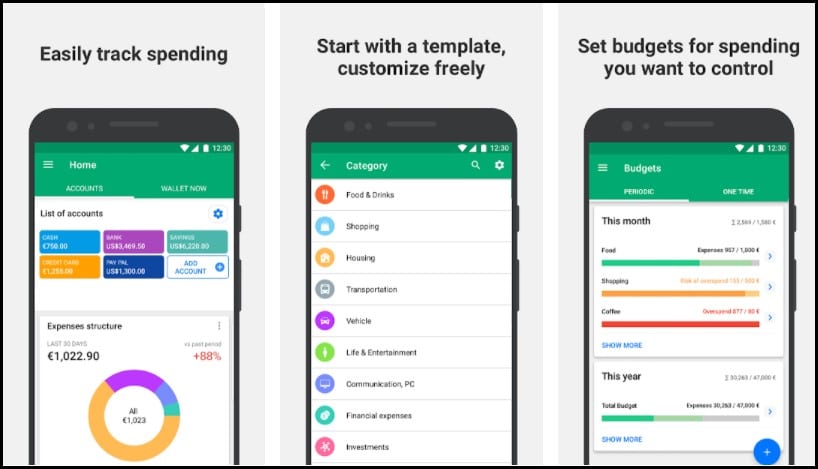

Wallet – best budgeting app for couples

The wallet app can be a personal finance manager that can gather all your financial data in one place. The app controls your expenses and encourages you to make savings. You get continuous insights about your financial position so that you are aware of your spendings.

To allocate the budget to a specific member of your family, you can share the monthly reports. The app has more than 3500 participating banks in its ecosystem, making it a red hot favorite for the users. The app will automatically update you about the transaction you recently made.

The app offers you flexible budget options that you can use to prepare your monthly budget and allocate expenditure to every item. This market-leading personal finance manager can be the best budgeting apps for you if you are looking to save bucks.

Related: Best Scheduling Apps

Standout Features:

- 3500+ Participating banks

- Allocate monthly budget

- Valuable financial insights

Download This Best Budgeting App

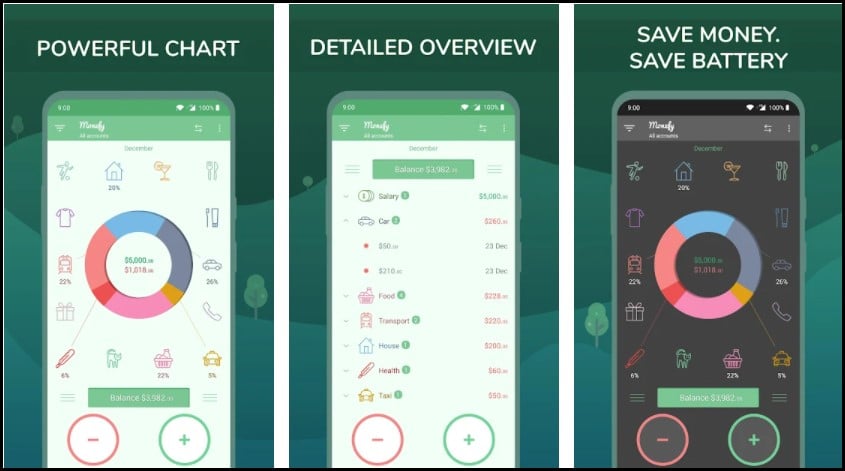

Monefy – best free budgeting app

To prepare a healthy budget and effectively allocate all your monetary resources, you can opt for the Monefy app. With its simple and intuitive UI, you not only can manage your wealth but can save bucks to buy your favorite stuff. You can record new transactions immediately so that you do not miss anything.

You can track your spending distribution via interactive charts to assess the grey areas of saving. The app also offers some handy widgets that give you a quick insight into your spending pattern. You can protect your data inside the app with a passcode so no third party can access it.

The in-built calculator will help you to sum up all your spendings quickly. You can sync all your financial data on Google Drive or Dropbox to keep it safe.

Related: Best Sleep Apps

Standout Features:

- Allocate monetary resources

- In-built calculator

- Handy widgets

Download This Best Budgeting App

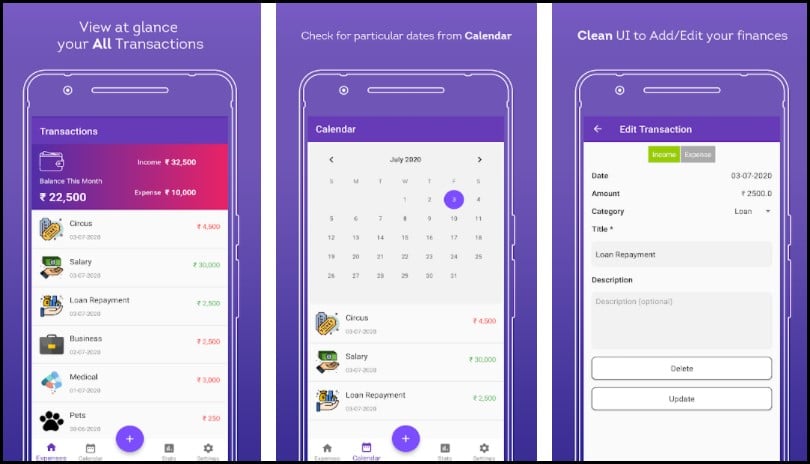

Money Manager – daily budgeting app

A bookkeeping app that will take care of all your finances, Money Manager is the latter app on the list. Expense is the first thing to look for before you start saving. The app tracks your daily expenses with its budget system. Once you are familiar with your spending pattern, you can eliminate unnecessary spending.

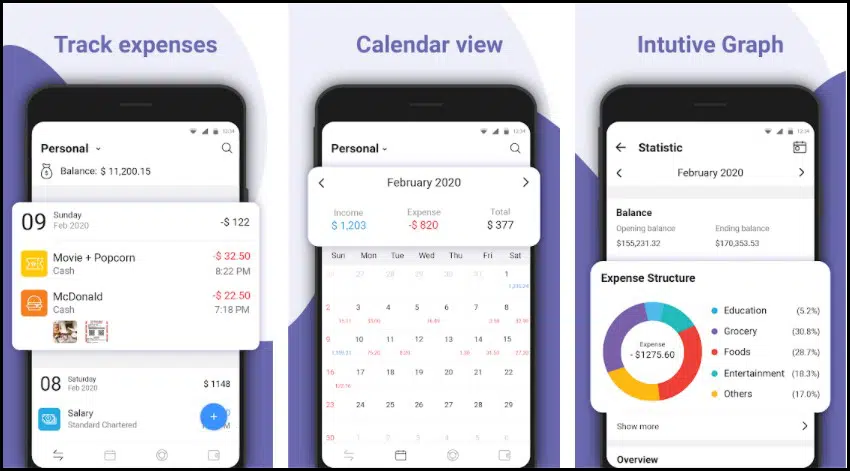

The app makes a budget for you within which you need to spend. It will help you to avoid compulsive buying and stay within your budget. Set your financial goals and hit them with the help of the Money Manager app. You can create multiple accounts and manage multiple wallets in this app. The app has an intuitive graph that makes sure you do not miss anything.

Related: Best Habit Tracking Apps

Standout Features:

- Budget system

- Create multiple accounts

Download This Best Budgeting App

You Need A Budget – weekly budgeting app

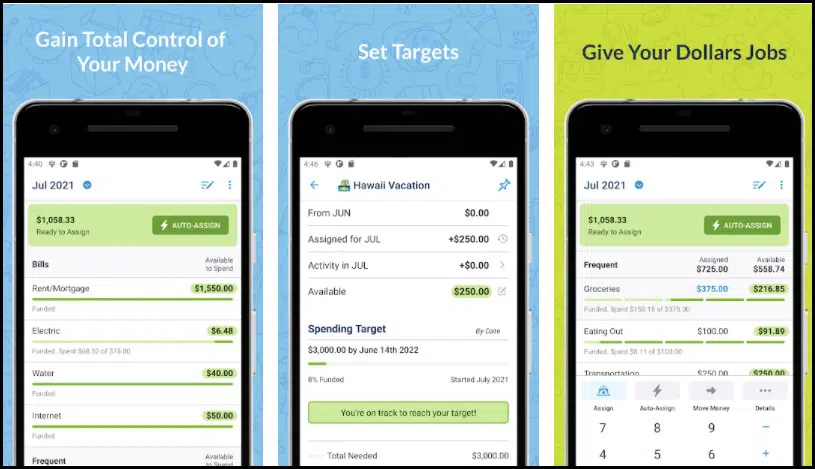

YNAB is an app that will help you to manage all your monthly finances and accumulate savings for the future. The app offers you detailed trend reports of your expenses that help to determine your financial position.

You can set your goals on the app and track them to see how frequently you hit them. Sync all your bank accounts and stay updated with all your transactions. You can also access your data across multiple devices so that you do not miss anything. The app offers four rules that are proven to save your bucks. You can do a quality check of the app with the 34 days free trial period.

Related: Best Yoga Apps

Standout Features:

- Goal tracking

- The detailed visual spending report

- Transaction matching

Download This Best Budgeting App

My Finances – budgeting app for android

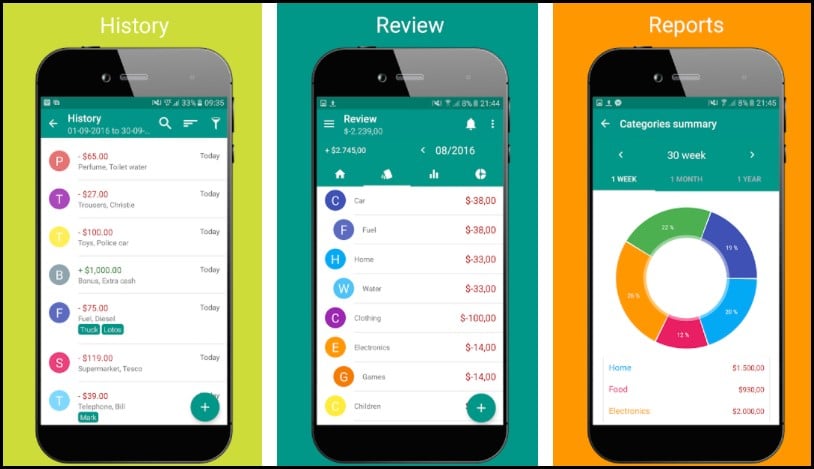

My Finances is an ideal expense controller and budget tracker you must-have in your pockets. It offers a wide range of features which is the primary reason for its inclusion on our list of the best budgeting apps. The app has an attractive interface that lets you attach all the incoming and outgoing transactions. You can create categories and subcategories of your cash flow and assign them colors.

The app allows you to manage multiple accounts at a time. You can filter each operation on the My Finances app to make it easy to know the sources of income and avenues of expenditure. With the help of interactive charts, you can analyze the budget of any month. There is a lot more this app has to offer, and you must try it.

Related: Best VPN App for Android

Standout Features:

- Intuitive interface

- Planned operations

- Interactive charts

Download This Best Budgeting App

GoodBudget – travel budgeting app

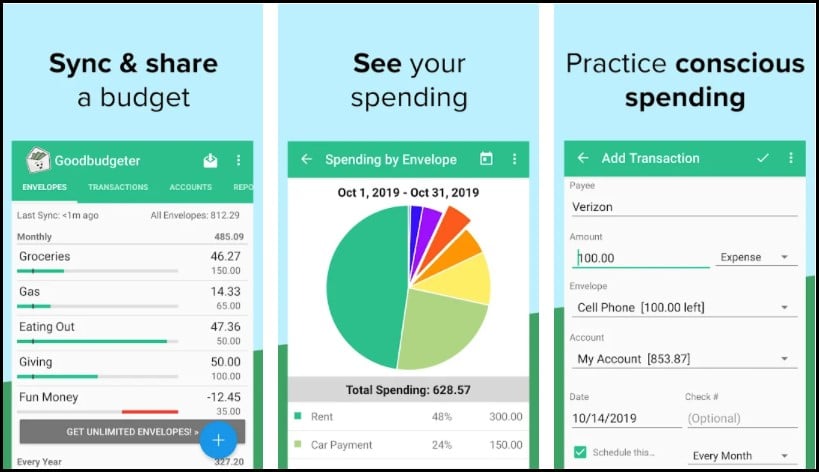

To plan your budget and get started with saving, Goodbudget can be a perfect app. This app offers a unique grandma envelope feature that encourages you to prepare a budget. You can set goals to save money in the future and get it done with this app.

You can schedule transactions to track items you are spending money on throughout the month. You can see your areas of spending with interactive pie charts. Practice conscious spending with the help of this app every time you are making transactions. The app offers you insightful reports that make it the best budgeting apps.

You get a Spending report, Income versus Spending report, to know your position at the end of every month. You can upgrade to the premium version of the app to get more useful features.

Related: Best Video Editing Apps

Standout Features:

- Income versus spending report

- Set goals

- Practice conscious spending

Download This Best Budgeting App

Pocket Guard – time budgeting app

Pocket Guard comes with 256 bit SSL encryption that makes it a reliable option. It is a free budgeting app that can take care of financial goals, organize your bills, and provide the best strategy to pay off your debt. You can optimize your monthly budget by learning about your spending habits. With the financial reports, you can have a detailed analysis of your income and expenses from different perspectives.

The app works as a bill organizer for the users. After successfully linking your bank account, the app detects your bills and subscription plan. You get reminders to pay the bills before the due date. With the help of the subscription manager, you can discover the forgotten subscription plans and minimize costs.

You can set your financial goals like a vacation or buying a new smartphone on the Pocket Guard app. Financial goals will help you stay motivated and work hard to achieve them. You can connect credit and loan plans with the app to avail of the best repayment strategy.

Related: Best Password Manager Apps

Standout Features:

- Financial reports

- Subscription manager

- The profitable debt repayment strategy

Download This Best Budgeting App

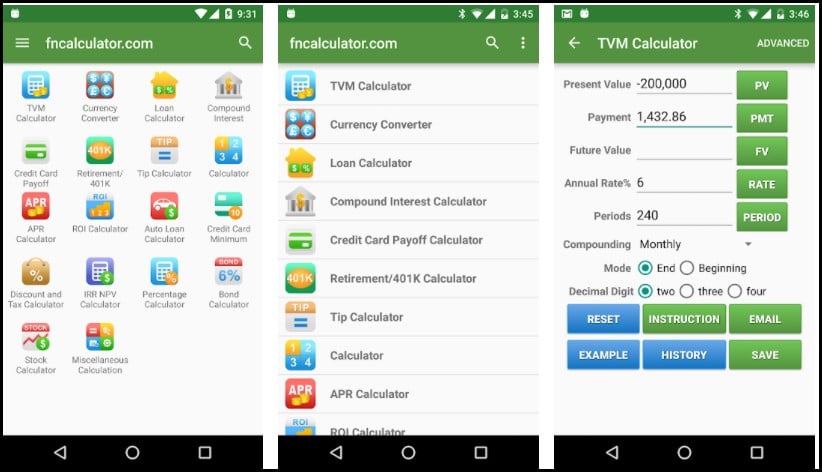

Financial Calculator – simple budgeting app

The calculation is often something we overlook and underestimate in our day-to-day life. Financial Calculator is one of the best budgeting apps users must try. You can calculate your investments, loan, mortgages, stock, retirement plans, lease, and credit card value with the Financial Calculator app.

In calculating your finances and investments, the app assists you with a TVM calculator, ROI calculator, IRR calculator, Currency converter, and Bond Calculator. It is a free app with no in-app purchases, making it one of the best budgeting apps.

Related: Best Coupon Apps

Standout Features:

- Mortgage calculator

- Investment calculator

- Free

Download This Best Budgeting App

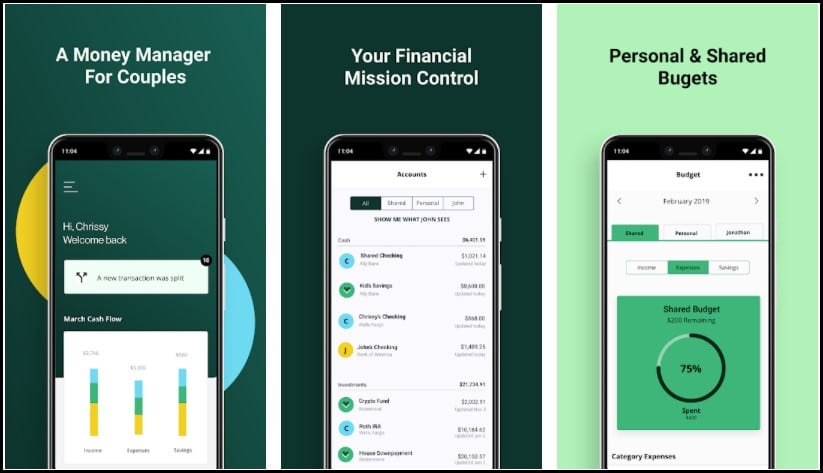

Zeta Money Manager – best money budgeting app

Zeta Money Manager can be one of the best budgeting apps for couples. Couples can split expenses to track their bills and reach their financial goals. The app sends push notifications so that you stay updated about all the financial updates.

You can set a weekly or monthly budget and plan your finances accordingly. The app has custom rules for viewing your data and financial alerts. You get high-grade encryption along with privacy controls to have an overview of your finances.

Related: Best Gallery App for Android

Standout Features:

- Set monthly budget

- Push notifications

- Custom rules

Download This Best Budgeting App

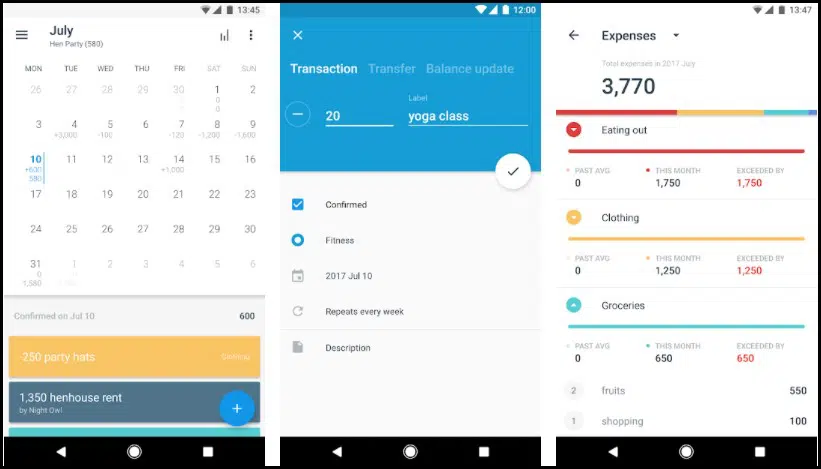

Dollar Bird – best budgeting app for iphone

Dollar Bird app provides a systematic approach to record your financial transactions. The app comes with a calendar-based interface to track and visualize your transactions. You can filter and categorize every financial entry with the help of AI on the Dollar Bird app. The app can automatically calculate the balance at the end of the day or month.

Automatic calculation of balances helps you plan your expenses with a historical record. You can collaborate with your family members to manage the monthly expenditure. This simple and user-friendly app can be handy if you are looking for the best budgeting app.

Related: Best Dating App for iPhone

Standout Features:

- Calendar-based interface

- Automatic calculation

- Collaborate with family members

Download This Best Budgeting App

Final Words

It was our comprehensive list of the best budgeting apps. You can choose any app from our listicle based on your financial goals. Your suggestions are worthy comment below to suggest some ideas. Mint, AndroMoney, Monet Manager, Wallet, and Pocket Guard are highly recommended apps for users. You can also comment on your top pick from our list of the best budgeting apps.

Thank you for reading! Try these out too:

- Best Nova Launcher Themes Setup

- Best KLWP Themes For Android

- Best Social Media Apps

- Best Music Streaming Apps

- Best File Manager Apps

- Best Lyrics Apps For Android

- Best Weather Apps For Android

- Best Password Manager Apps

- Best KLWP Themes For Android

- Best Real Estate Apps

- Best Calendar Apps

General FAQ

Is Mint a good option for budgeting apps?

Yes, Mint is a highly-rated budgeting app users prefer. Besides useful budgeting features, the app has high-grade software and hardware encryption along with multi-factor authentication. Mint can be the ideal choice for personal as well as professional use.

How can I keep track of the budget?

The basic thing you need to consider to keep a track of the budget is the inflow and outflow of cash. To know the cash flow, you can analyze your bank statements, monthly bills. Also, you need to determine all the sources if income to determine your monthly budget. Once you have analyzed income versus spending, you can keep a smart track of your finances and manage your budget accordingly.

Which are the safest budgeting apps?

Mint

Money Manager

Monefy

GoodBudget