Mobile payment apps have certainly made our life easier and better. We can now pay anyone via our smart devices sitting at our home or driving through the highway. Mobile payment apps have multiple utilities and are used for various purposes. Best mobile payment apps are those that can get all your things done in one place.

For this purpose, we are compiling a list of the best mobile payment apps that can be useful for household, business, and across-the-border transactions. You can use these apps for domestic transactions as well as international payments.

Excited? So, let’s get started.

Benefits of Best Mobile Payment Apps

Digital payment has become a norm now. Whether it’s an individual or big business, everyone opts for the digital mode of payment while making transactions. These could be some of the reasons you can install the best mobile payments apps on your device.

- Multi-utility: A mobile payment app has multiple utilities. You can pay your bills, make mobile and DTH recharge, transfer money from one bank account to another, and book tickets. Multiple utilities of these apps make it a must-have on your pocket devices.

- Time-saving: Imagine standing in long queues and waiting for hours to pay your bills. Now you do not need to stand in queues, thanks to mobile payment apps that have made it convenient to do these tasks in a click and save your time.

- Secure: Carrying a large amount of cash in your wallet is not a good option. These mobile payment apps eliminate the need of doing so. All your money is digital numbers that are accepted at every place. You just need to install the app on your device and you are good to go with your payment.

Best Mobile Payment Apps

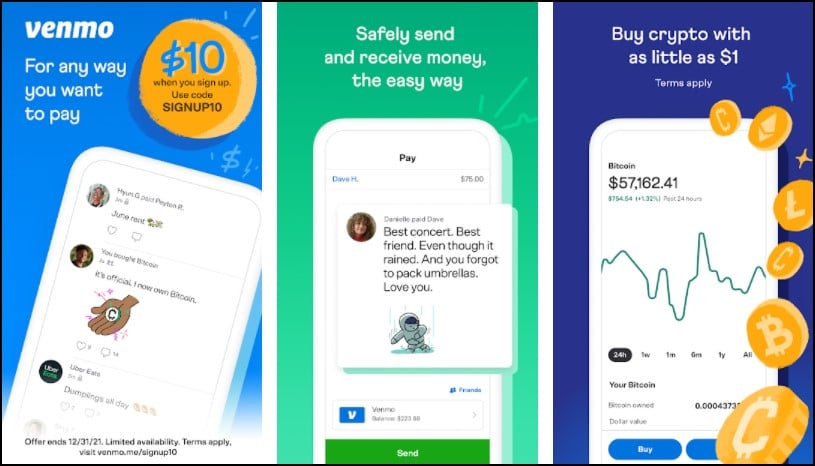

Venmo

Venmo is one of the best mobile payment app, and it’s a platform that is ideal for social settings. The app has over 65 million users, and it’s one of the best platforms for paying monthly bills or exclusive celebrations.

Many people consider Venmo as their priority choice for peer-to-peer payment, and more than that, it’s a mobile hub that takes care of all your financial requirements. The applications contain numerous beneficial features. The most primary one is that the app lets you send and receive money conveniently. You can also add a note to every payment; thus, they remember the gesture from you.

You will also get up to 3% cashback through Venmo if you meet the eligibility criteria. The money you receive can be spent just like regular payments through the app. You can also shop anywhere through the Visa® credit cards.

Another significant benefit of Venmo is that if you have funds stored in the payment gateway, you can use the Venmo QR code to pay at stores such as CVS touch-free. Simply scan your phone and pay the money. The platform at the top of being the best mobile payment app is also an exceptional choice for managing money. You can instantly transfer money from Venmo to your bank account or receive your paycheck two days earlier using the direct deposit feature. Additionally, the scan payments through the app remain one of the best choices out there.

Related: Best Guitar Tuner Apps

Standout Features:

- Ideal for business and personal transactions

- Money management features

- Intuitive user-interface

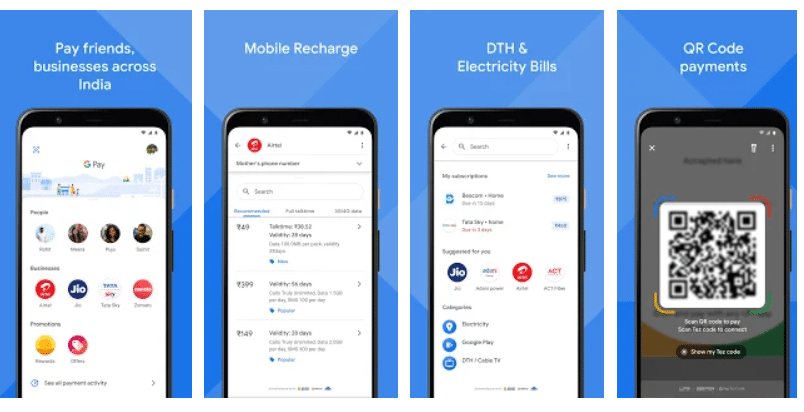

Google Pay – Best Mobile Payment Apps

Pay your bills, DTH recharge, mobile recharge, UPI transfers, and many other services are provided by the Google Pay app. You can add your debit and credit card to the app and make online payments to get started. You can book flights, order meals, find the latest prepaid recharge plans, and get rewarded for doing all this.

You get exciting offers after using the services of this app that can be redeemed to avail discounts. Make payments simply by scanning the QR code and you are good to go. Transfer money from one bank account to another hassle-free. You can also transfer money to those who are not on the Google Pay app. KYC is also not needed to start making transactions, which makes it the best mobile payment apps.

The app also offers you investment avenues where you can trade gold according to the market trend. The gold will be deposited in your Gold locker or will be delivered to your doorsteps. You must go for this app if you are looking for a one-stop solution for all your financial needs.

Related: Best Home Workout Apps

Standout Features:

- No KYC needed

- Multiple layers of security

- QR code payments

- Rewards

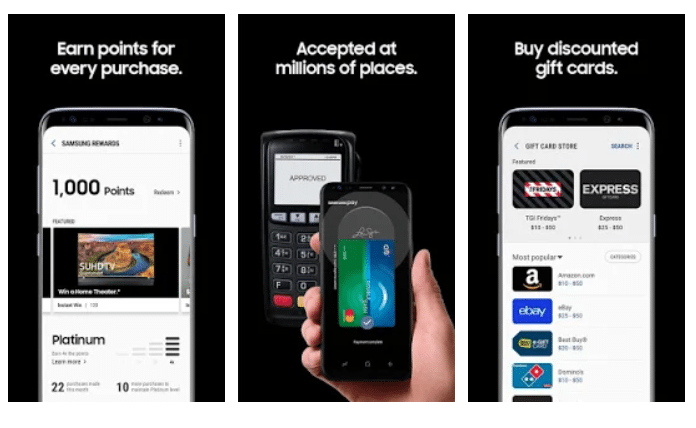

Samsung Pay – Best Mobile Payment Apps For Android

Samsung Pay is a popular payment app that is highly preferred by users for making transactions. The app has a simple interface and an extra layer of security for your sensitive data. You can integrate your debit, credit, and membership cards with the app to make payments for every purchase.

The app rewards you for every purchase you made through it. You can redeem the reward points to buy any Samsung products from the stores. The app is acceptable at multiple stores where you can seamlessly make payments. All your card information is encrypted in a secured data vault to keep the sensitive details confidential.

Standout Features:

- Acceptable at millions of stores

- Points for every purchase

- Simple User Interface

Apple Pay – Secured Mobile Payments Apps

Exclusively for Apple users, we have Apple Pay next up on our list of best mobile payments apps. Develop specifically for Apple users, the app offers you payment services and some additional benefits for using its services. You can use the app to send and receive money with the help of a single touch. If you are not in the mood to touch your smartphone, then ask Siri to do the payment for you.

Use your debit and credit card to make the transactions without the fear of data leakage. The app uses a device-specific number and a unique transaction code which is stored on the Apple servers, not on your device. Your card number is not shared with the merchants you are dealing with. You also get 2% cashback when you use an Apple card with Apple Pay. You can also make seamless transactions with the help of your Apple smartwatch using the Apple Pay app.

Related: Best Weight Loss Apps

Standout Features:

- Contactless payment with Face ID

- Cashback

- Data and transaction privacy

- Apple cash wallet

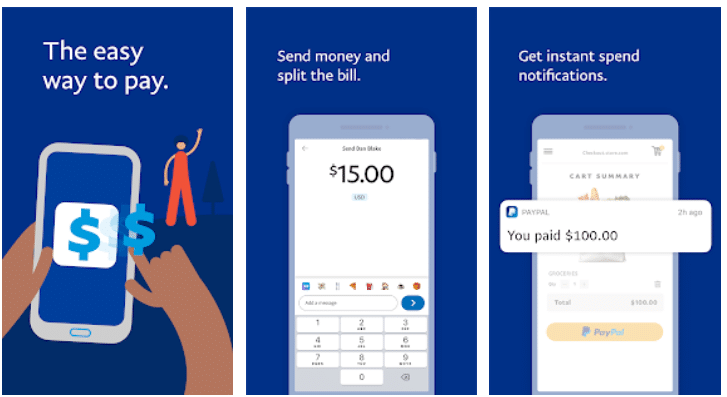

PayPal – Best Mobile Payment Apps For Cross Country

Paypal could be the answer to your questions if you are making across-the-border transactions. With the help of PayPal, you can send and receive money in different currencies. Just scan the QR code of the receiver and you are ready to make payments. You only need to type the Email, Phone number, or name of the person to whom you want to make the payment.

You will get instant notification when you make a transaction to keep a record of your spending history. If you are a seller you can set up your QR code to start getting paid. The app offers useful financial services that make it one of the best mobile payment apps.

Standout Features:

- Can send different currencies

- Instant spending notifications

- No transfer charges

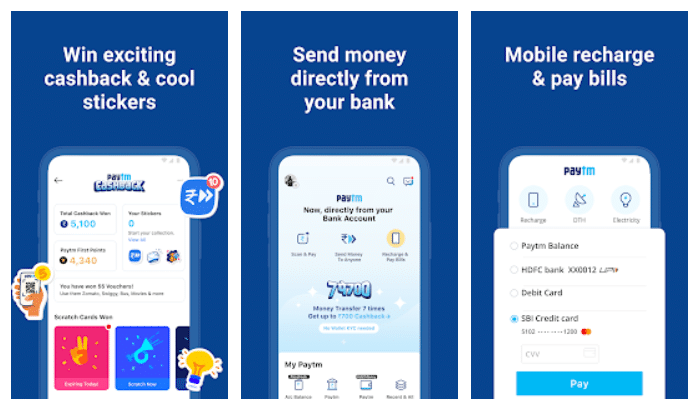

Paytm – Best Mobile Payment App in India

Paytm offer one of the widest range of financial services that makes it the best mobile payment apps. Apart from making transactions, the app offers various investment options to grow your money. You can send and receive money at any number in your contact list or any bank account. You can manage multiple accounts at a time and the app supports more than 140 banks in India.

Recharge your DTH, Metro card, and Mobile number using the Paytm app and get exciting rewards and cashback. You can also use Paytm Wallet as your FASTag account that supports all the major service providers. You can buy and sell gold which will be stored inside secured lockers. Check your credit score to know your creditworthiness.

You can also apply for Paytm postpaid where you get a credit limit of up to 100,000 INR. Shop for your favorite brands on the Paytm Mall and get the benefits of the latest offers.

Related: Best Sports Apps

Standout Features:

- Buy and sell digital gold

- Check free credit score

- Online shopping in Paytm Mall

- Secure and contact fewer payments

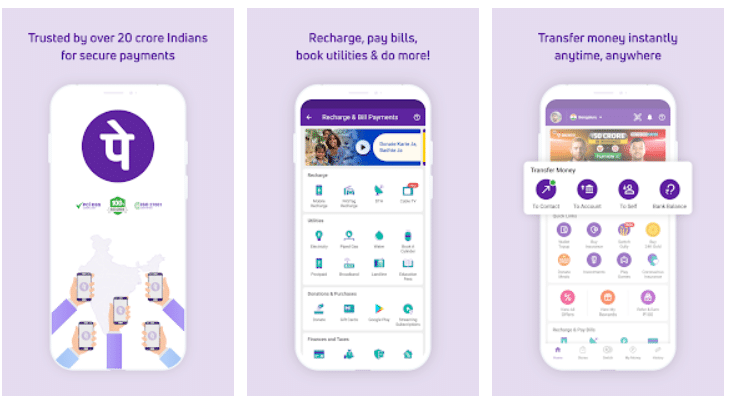

PhonePe – Best Mobile Payment App

You can do a lot of things with the PhonePe app. The app offers a wide range of financial services like investing in mutual funds, buying digital gold, taking insurance plans to secure your health, and so on. You do not need to do KYC as you can simply pay or receive money on mobile numbers directly.

Apart from making online payments, you can use the ‘Phonepe Switch’ to order food, book tickets, and buy groceries without downloading the apps. The app supports more than 140 banks across India where you can add beneficiaries and manage multiple accounts at a time. Pay your utility bills on any platform as the app supports more than 180+ billers.

You can ensure your health by taking insurance plans starting at 199 INR. Apart from health, you can take multi-trip insurance plans during your travels. If you want to save tax then do opt for the tax-saving funds on the app.

Standout Features:

- Supports 180+ billers

- Easy User Interface

- Cheap and affordable insurance plans

- Wealth management

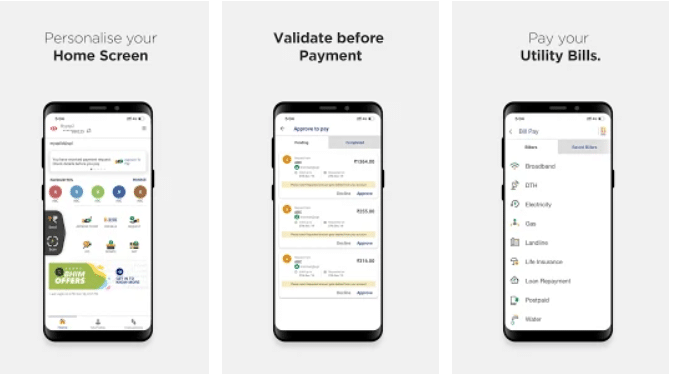

BHIM UPI – Best Unified Mobile Payment Apps

For fast and instant digital payment we have a BHIM UPI app for you. It is a unified payment interface that is compatible with multiple digital platforms. Just scan the QR code of BHIM UPI and it will redirect you to the app via which you want to make the payment. Just make sure that your mobile number is linked with the bank account you are using the app with.

The app has a daily transaction limit of 40000 INR which may vary according to your bank account limit. The simplified and unified payment interface of the app makes it one of the best mobile payment apps. The app is compatible with Android 5 and above devices.

Related: Best Credit Score Apps

Standout Features:

- Unified payment interface

- Fast and secure

- 40000 INR daily transaction limit

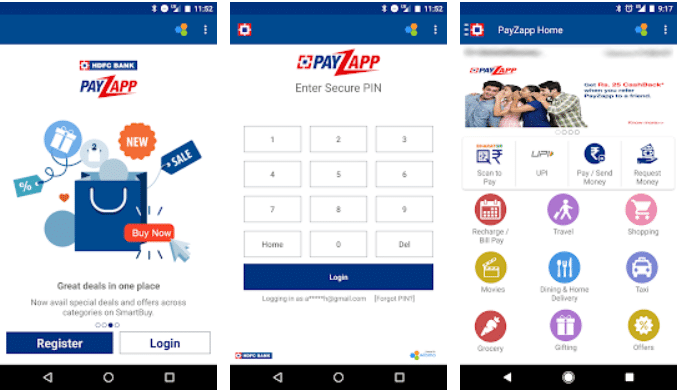

Pay Zapp – Best Mobile Payment Apps For Business

PayZapp is an online payment service offered by HDFC Bank Ltd. You can pay your bills, compare and book flights, book hotels, buy movie tickets, and avail yourself of great offers at one place. Link your debit and credit card with the app and make daily transactions. The app uses a proprietary technology that makes three security checks for every transaction. Your card details are secured and do not get stored on the device.

Related: Best Personal Finance Apps

Standout Features:

- Convenient, Fast, and Secure

- Wide range of services

- Three-step security check

Razor Pay – Best Mobile Payment Apps

Razor Pay offers you multiple payment options that make it highly preferable for the users. The app has plugins for all the major platforms that make it easily accessible to users all around the globe. You get instant activation within minutes to start using the app for online payments.

The app has more than 100 payment options that primarily include Netbanking, UPI, Wallets, Debit, and Credit card. The Dashboard reporting feature helps you to keep track of your transaction history. The app can be a good option for professionals and business people who are looking for the best mobile payment apps.

Related: Best Anime Apps

Standout Features:

- Instant activation

- 100+ payment modes

- Easy integration

- Dashboard reporting

Skrill – Best Mobile Payment Apps

Skrill can be a good option for those users who make a large volume of international transactions. The app supports more than 40 currencies across 180 countries. The app has low and transparent transaction costs that make sure that there is no hidden cost involved.

You can buy and sell cryptocurrencies like bitcoin, Ethereum, Litecoin, XRP, and XLM. You can choose from 100 alternative payment methods in 40 currencies to make the payment while buying a cryptocurrency. You can load the amount into your Skrill account via debit and credit card.

You can also get a Skrill Mastercard that will help you to withdraw cash from various ATMs across the globe. The app has interactive customer support that will solve your queries quickly.

Related: Best Free VPN Apps

Standout Features:

- Supports 40 currency across 180 countries

- 100 alternative payment methods

- Buy and sell bitcoins

- Real-time notifications

Final Words

Start making mobile payments by installing these best mobile payment apps on your devices. Do not forget to comment about the most useful mobile payment app that you will be giving space to in your smartphones. Do not forget to share our content to improve the reach.

Thank you for reading! Try these out too:

- Best Compass Apps For Android

- Best Collage Apps For Android

- Best Authenticator Apps For Android

- Best Step Tracker Apps For Android

- Best Logo Maker Apps For Android

- Best Phone Tracker Apps For Android

- Best Battery Saver Apps For Android

General FAQ

What is the best mobile payment app?

Our list contains a variety of choices suitable for different categories of people. However, some of the most popular ones are Google pay, PayPal, Paytm, and Apple Pay.

Will I have to scan a QR for transferring funds with the best mobile payment app?

Yes, many of the best mobile payment apps benefit from making payments by scanning the QR code. It makes payments convenient and increases the benefit of payments.

Can I transfer money to my bank account using the best mobile payment app?

Yes, the apps provide an easy gateway for transferring payments between bank accounts and these platforms.