Creditworthiness portrays the potential of an individual or organization to pay off its debts on time. But most of us are not familiar with the parameters to check the credit score and know your creditworthiness. If you fall in the same category, our listicle of the best credit score will help you out.

Various parameters are taken into consideration to determine the credit score. Our listicle contains the best credit score apps that make you familiar with the financial terms related to your credit score. Most apps on our list give credit scores to the users based on the top 3 credit rating bureaus Equifax, Transunion, and Experian.

Our listicle contains some complex financial terms that readers might find difficult to understand. We are defining those terms for ease of understanding for our readers.

Excited? So, Let’s Get Started.

Important credit score terminologies

FICO: FICO or Fair Issac Corporation is a software analytics company that provides a range of goods and services. Credit ratings are the primary services FICO provides to lenders. FICO credit scores help the lenders to assess the credit risk related to a particular borrower. Credit rating scores range between 300 to 850, and if your score is more than 670, you are a good borrower. FICO calculates the credit score on five parameters new credit accounts, payment history, current indebtedness, credit use type, and length of credit history.

Credit rating bureaus: Credit rating bureaus are the entity that compiles the credit reports of the organization. The credit rating reports are valuable information sources for the banks, financial institutions, and government bodies. These reports assist the lenders in determining the creditworthiness of any individual or organization. There are numerous credit rating bureaus, and each rating criteria has a slight variation. Leading credit rating bureaus are TransUnion, Equifax, and Experian.

We would also like to highlight some benefits of the best credit score app before moving towards our listicle.

Benefits Of Best Credit Score Apps For Android

- Credit eligibility: If you frequently track your credit score, you can get to know about your credit eligibility. You can take the assistance of the best credit score app to analyze your credit score. It will help you gain insights into your credit history and take the necessary measures to improve your credit score.

- Savings: You do not need to hire any fund manager or expert to guide you in the borrowing process. All you need to do is install the best credit score apps, and you are good to go. In this way, you can save the fees of the consultant that will increase your savings.

- Swift approval: Lenders also rely on the best credit score apps to extract vital information from the borrowers. Timely loan payments to the lenders without default result in high chances of quick credit approval. Credit score apps help you in managing your credit performance and yield the best credit rates.

Best Credit Score Apps For Android

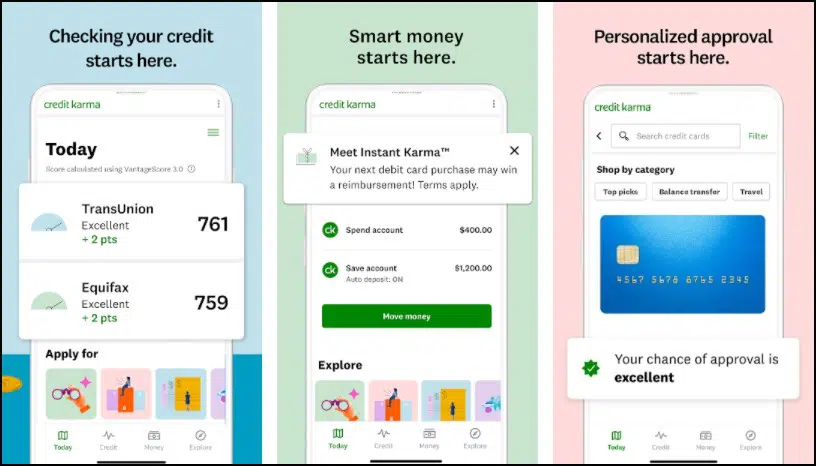

Credit Karma: best credit score app in 2021

You can start your financial journey progress with the Credit Karma app. It assists you in gaining insights from the field expert about your credit score. The app continuously monitors users about the dynamic changes in your credit scores. You can analyze the factors that affect your credit score and take the necessary measures to improve them.

The best credit score app provides varied financial products like cards, home loans, automobile loans, and accounts. You get recommendations based on your credit score about the wise usage of the credit score. You also get stipulated loan terms with the best rates. The app has 128-bit high-grade encryption to protect your confidential information.

Related: Best SlideShow Apps For Android

Standout Features:

- Insight from experts

- Recommendations

- Credit monitoring

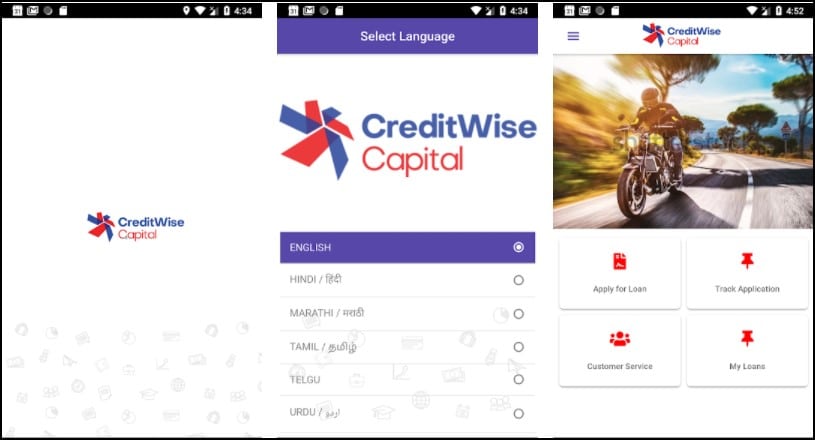

CreditWise: Top credit score app

CreditWise is a financial app by Capital One that can help you actively monitor your credit score. You get credit reports and ratings from the leading rating agency, TransUnion. The app has a credit simulator feature to get familiar with the everyday decisions that affect your credit score.

Weekly TransUnion VantageScore is handy in active tracking of the credit score. Personalized suggestions from the experts help you to improve every aspect of your credit score. You also get daily tips to improve your credit score, making it one of the best credit score apps.

Related: Best Pedometer Apps For Android

Standout Features:

- Credit simulator

- Personalized suggestions

- Alerts

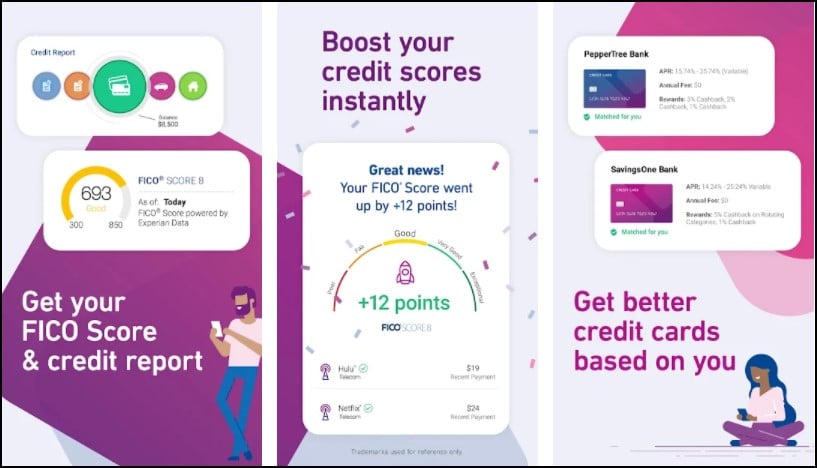

Experian: free credit score app

Experian is the first company in the US to provide online credit rating services, making it one of the best credit apps. The app offers a plethora of features ranging from FICO scores to credit alerts. You get a FICO score that helps you know the Dos and Dont’s of credit score. Also, you can get to know about the lender’s perspective like inquiries, public records, and credit accounts. The app can negotiate for your bills once you upload them.

You can integrate your financial accounts with this best credit score app to boost your FICO score. Compare multiple credit options and see the best credit card offers to match your needs. The push notifications feature will give you instant alerts of any changes in your Experian account. You can lock your account to protect your sensitive information from online predators.

Standout Features:

- FICO scores

- Push notifications

- Credit lock

Privacy Guard: best free credit score app

Monthly triple bureau reports are all you will be getting from the Privacy Guard app. You can monitor your monthly credit reports from the three leading credit bureaus of the US. Besides providing reports, Privacy Guard offers protection and privacy to your confidential data. The app offers social security numbers and identification numbers to save yourself from online scams.

A credit score simulator will keep you in check of the factors that can positively or negatively affect your credit score. You can use the credit score information hotline to get any assistance. Activate Email, text, and push notifications to get instant alerts of frauds. You can take the $1 trial plan for the first 14 days. After the free trial, you can take the $9.99 monthly plan.

Related: Best Invoice Apps For Android

Standout Features:

- Social security number

- Credit score simulator

- Online fraud assistance

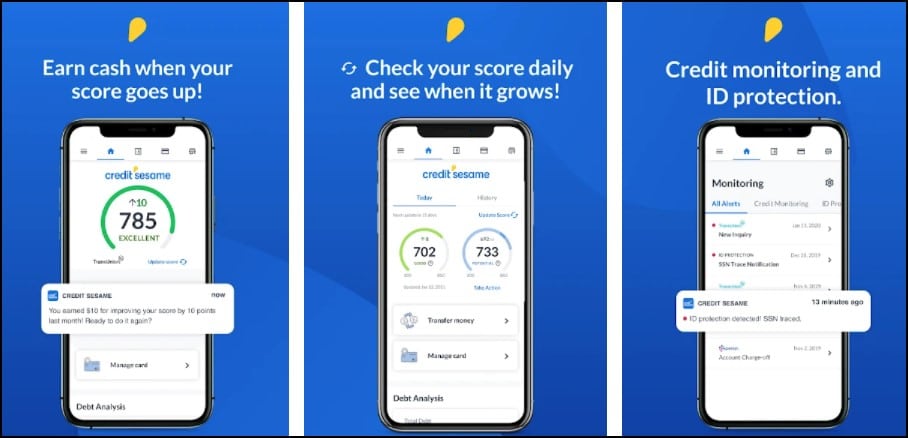

Credit Sesame: must have credit score app

Build a healthy credit score with the credit features of the Credit Sesame app. The app offers tailored credit cards that can help you meet your financial goals. You can get a free credit score, a free credit report card, and credit monitoring alerts with the Credit Sesame app. Keep a close eye on all the activities that can earn your credit score.

You can earn cash in the no-fee sesame debit account when your credit score improves. The app offers valuable financial literacy content related to your credit score. You can learn how to build a healthy credit score, ways to improve credit score, and a guide to credit repair from the financial literacy content.

Related: Best Hotel Apps For Android

Standout Features:

- Tailored credit cards

- Financial literacy content

- Earn cash

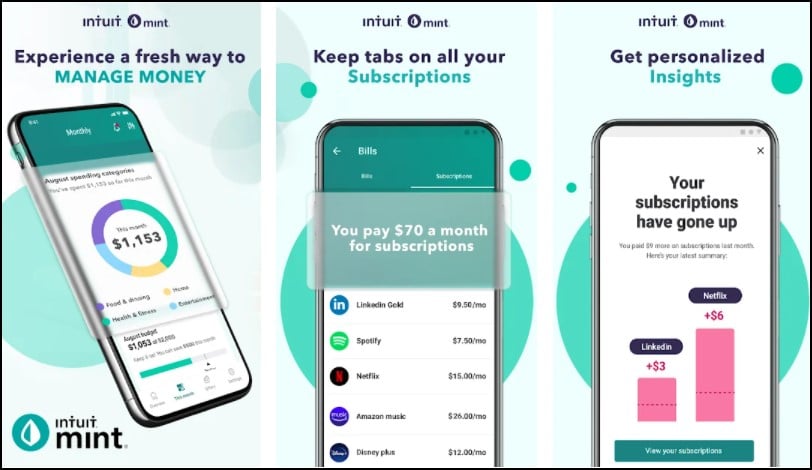

Mint: most accurate credit score app

Mint uses a simple approach to assist its users in knowing their credit scores. You can verify your identity, and Mint will do the rest for you. After verification of your identity, the Mint app will break your credit scores into macro components. You can critically analyze the macro components to know the areas of improvement.

You can also learn some tips about your credit scores that will be handy in calculating your creditworthiness. Mint is an all-in-one financial app that could be one of the best credit score apps if you are hunting for one.

Related: Personal Finance Apps

Standout Features:

- Break down the scores

- Handy recommendations

- Multi-utility

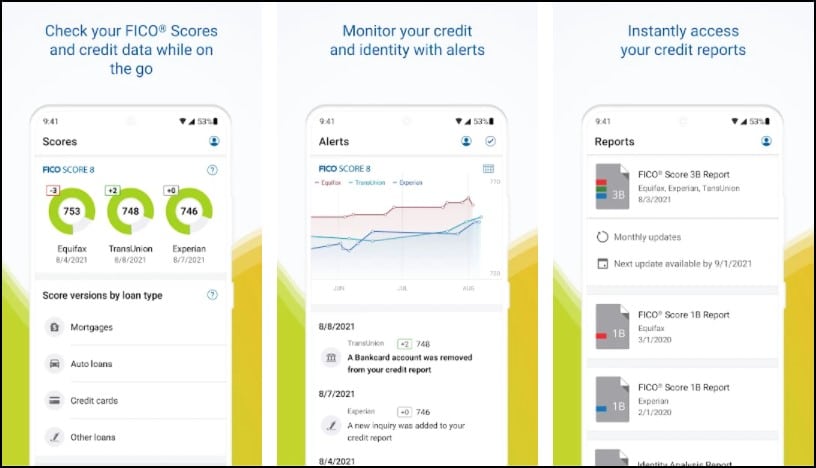

MyFico: best credit score app for iphone

FICO is the leading credit score parameter lenders prefer to assess the credit risk and creditworthiness. MyFico offers valuable features like FICO score simulator, alerts, reports, score history graph, and credit education to the users. You can instantly access your credit reports and data, making it the best credit score app on our list.

The app provides a biometric identity verification feature to keep your data secure. You get frequent alerts to monitor your credit score. You also get access to insights that help you the factors affecting your FICO scores. Additionally, MYFico has educational videos and content to improve the financial literacy of the FICO scores.

Related: Best Reminder Apps For Android

Standout Features:

- Score history graph

- Educational videos

- FICO score simulator

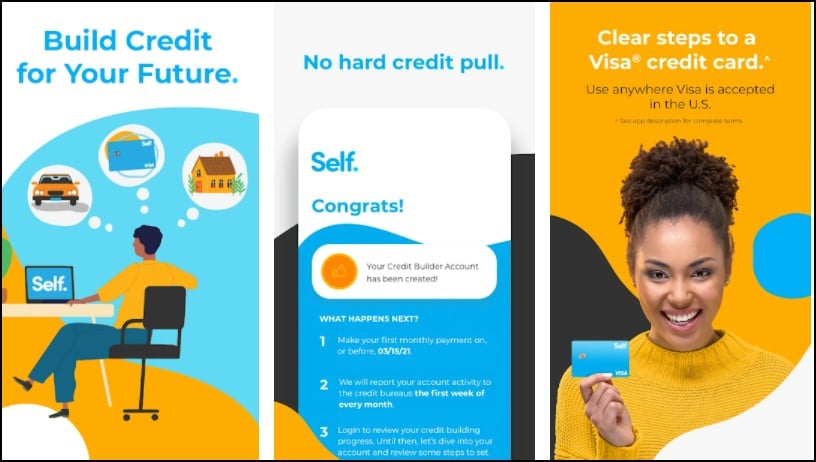

Self: best credit score app for Android

This best credit score app monitors your credit score and reports to all three credit bureaus, making it one of the best credit apps. The app does not do any “hard pull” credit check that makes it convenient for the users to access the credit scores. You can monitor the credit usage apps effectively with the Self app.

The app is handy to build a credit-builder account and save on your deposits. Credit builders help you maintain a healthy payment history. The app has 256-bit encryption protocols for the security of its user’s data. You can take the $25 starter plan of the app to get started with the Self app.

Related: Best Project Management Apps

Standout Features:

- Credit builder

- Monitor credit usage

- High-grade encryption

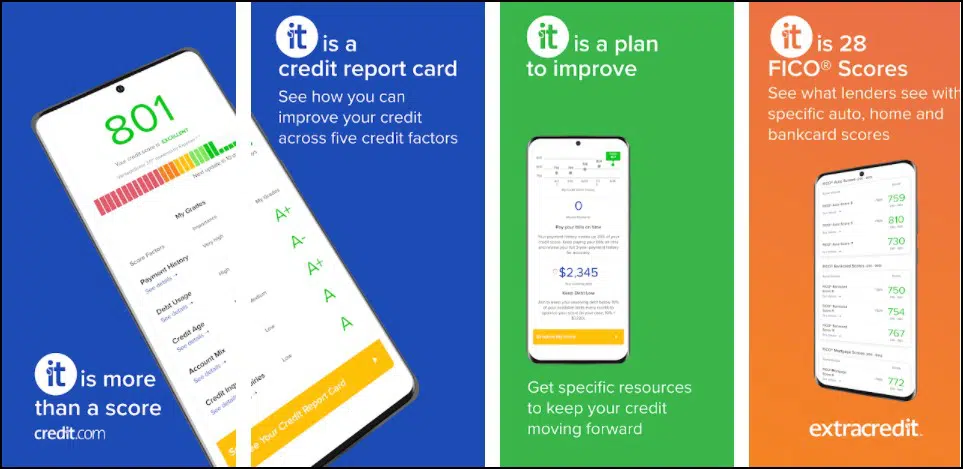

Credit.com: best app to check credit score

Moving further, Credit.com is another optimal choice for the users. You get free credit scores and updates to track your progress over time. The app offers personalized action plans that you can follow to build a healthy credit score. With the interactive timeline, you can access all the factors that can affect your credit score. Besides, you get videos, articles, and tips to improve your financial literacy.

Standout Features:

- Interactive timeline

- Educational content

- Action plans to build a healthy credit score

Credit Secure: best overall credit score app

Credit Secure by American Express is a popular and best credit score app users prefer. American Express is a highly reputed name in the finance sector that enhances the credibility of the app. You can access financial tools to gain an in-depth understanding of the factors affecting your credit score.

The app provides you the feature of refreshing your FICO scores every 30 days. Also, you can refresh the 3-bureau credit reports every month. The app sends you alerts when there is a threat to your data. The app suggests tips to utilize your credit wisely. You can buy the app for $1 for the first 30 days before opting for the full-fledged $16.99 monthly plan.

Standout Features:

- Valuable financial tools

- Refresh FICO scores

- 3-Bureau credit reports

Final Words

Improve and secure a lender-friendly credit score with our listicle of the best credit score apps. CreditWise, Experian, Credit Sesame, and Credit Karma are some recommendations for the users. You can drop your valuable comment and suggestions in the comment box. Also, you can tell us about your favorite picks on the list.

Thank you for reading! Try these out too:

- Best Free VPN Apps for Android

- Best Music Streaming Apps

- Best File Manager Apps

- Best Password Manager Apps

- Best KLWP Themes For Android

- Best Anime Apps For Android

- Best Texting Apps For Android

- Best Radio Apps For Android

- Best Call Blocker Apps For Android

General FAQS

What CIBIL score is good for loan or credit approval?

A CIBIL score between 700 to 900 can get the job done for you. You need to have a good credit history without any default or delayed payments to achieve the CIBIL score of 700-900.

Which are the leading credit rating bureaus?

There are hundreds of credit rating bureaus that give credit ratings and reports. The leading credit rating agencies are Experian, TransUnion, and Experian.